Examples & Practice of Decision Tables Copy

Let’s look at some more examples!

EXAMPLE 1

Maybe your requirement looks like this:

Our pricing and rates for loans are based on Customer Tiers. The rules for Customer Tiers are as follows:

- Tier 1= Loyal 10yrs, Mortgage with us, and 100K in assets with us

- Tier 2 = Mortgage with us and 10yrs loyal

- Tier 3 = Loyal 10yrs, and 100k in assets with us

- Tier 4 = Loyal 10yrs

- Tier 5 = 100k in assets with us

- Tier 6 = All Others

How do we make this into a Decision Table to drive ALL of the scenarios? (Warning, answer below….try it before scrolling down!)

First, identify the actual decision this rule/logic set is trying to make.

Second, what are the conditions that are evaluated to make the decision?

Third, populate the combinations, and then the results.

<<< WARNING – ANSWER BELOW – DID YOU TRY THIS BEFORE SCROLLING? >>>

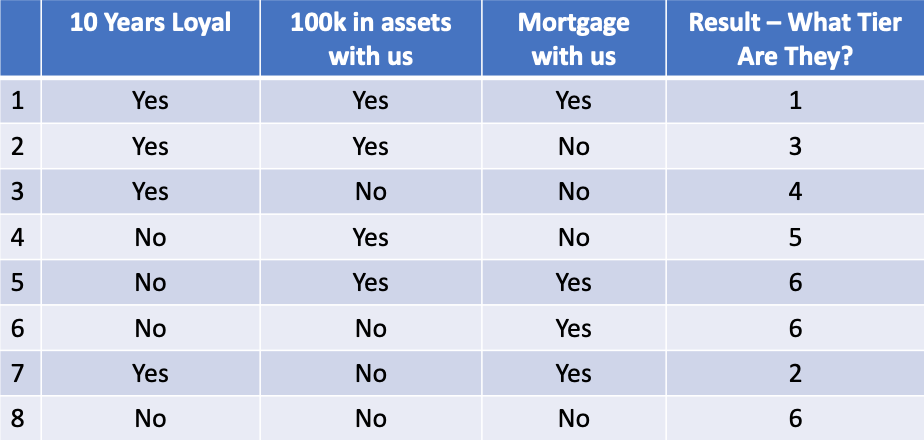

Okay, here is an example of what this might look like. It illustrates out all 8 scenarios. Did you find 3 conditions and 8 scenarios?

Okay, are you ready for another one?

EXAMPLE 2

Maybe your requirement looks something like this:

- If an account is overdue more than 15 days, then the customer pays a late fee.

- Late fees rules:

- 10% of it is 15 days or more

- 15% for amounts delinquent more than 30 days

- 20% for amounts delinquent more than 60 days

How do we make this into a Decision Table to drive ALL of the scenarios? (Warning, answer below….try it before scrolling down!)

First, identify the actual decision this rule/logic set is trying to make.

Second, what are the conditions that are evaluated to make the decision?

Third, populate the combinations, and then the results.

<<< WARNING – ANSWER BELOW – DID YOU TRY THIS BEFORE SCROLLING? >>>

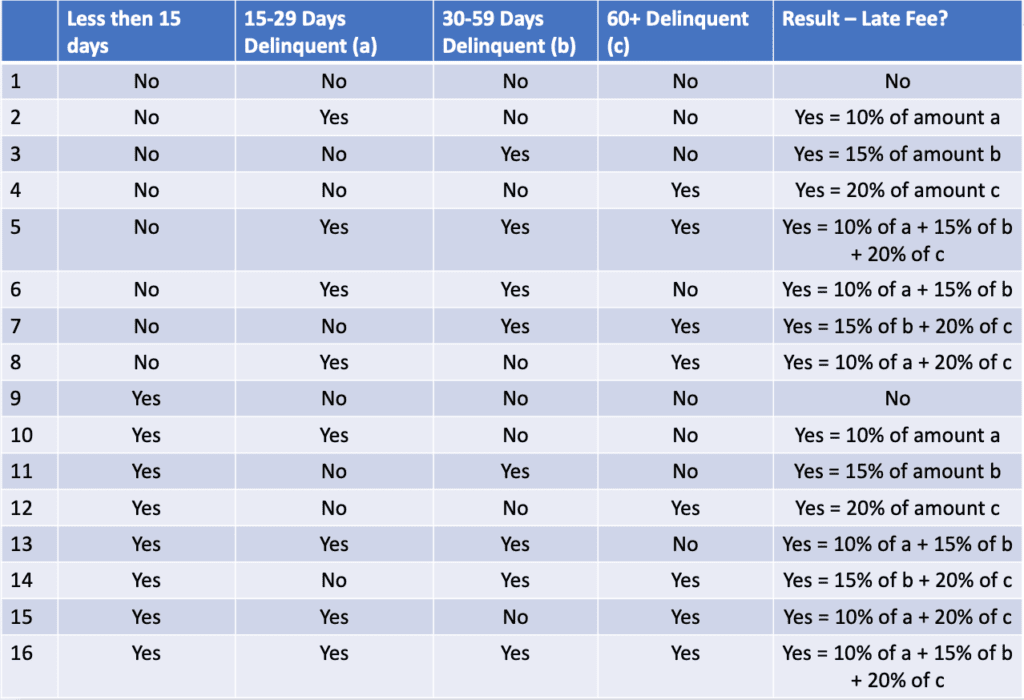

Okay, here is an example of what this might look like. It illustrates all 16 scenarios. Did you find 4 conditions and 16 scenarios?

And, it helps to add a scenario as well. Something like this:

Scenario A: A customer has an outstanding balance of $100. $50 is the recent invoice and less than 15 days, $20 is 29 days overdue, and $30 is 59 days overdue. This fits line 13 of the decision table and the late fee would be: $6.50. This is 10% of $20 plus 15% of $30.

KEY LEARNINGS:

- Both examples have bullet point logic to start, they seem quite clear, but when using a decision table, there were far more scenarios identified. This makes the requirement more clear for the developers and testing/QA team. Without this clarity, the “missing” scenarios may not be programmed or tested. Or worse yet, they are programmed or tested but with the incorrect result.

- The more conditions you have, the more scenarios you get, EXPONENTIALLY!

- The data/nouns in your conditions must be defined VERY well.

- For example: What does “loyal” mean? How is it calculated? Maybe that is another decision table?

- For example: How are the delinquent days calculated exactly? From what date/time to what date/time?